New Playbook, Same Goal. A substantial update for OTCID: PNXP

- buffalofiresidecha

- Dec 29, 2025

- 4 min read

by

by Eric J. Kemnitzer

Industry: Real World Asset (RWA) Digital Lending

Theme: The halftime adjustment that changes the entire game

Follow Pineapple Express aka RWA on X: https://x.com/rwaloan

Every once in a while, a company realizes the game it prepared for isn’t the one being played anymore — and instead of stubbornly forcing bad plays, it changes the game plan. That’s exactly what PNXP has done, and it’s why this name quietly sits near the top of our “don’t blink” list heading into 2026.

Let’s start with the obvious: a sub-$250K market cap on a company pivoting into one of the fastest-growing financial sectors on the planet is, frankly, absurd. The stock went through its rough patch — including noteholder selling tied to its former cannabis direction — but those days appear increasingly in the rearview mirror. What’s emerging now is not a cannabis story at all, but a digital lending infrastructure play aligned with where capital markets are actually headed.

This feels like the Bills coming out of halftime, scrapping what didn’t work, and letting Josh Allen do what he does best — attack open space (disregard....yesterdays Eagles game).

From Cannabis to Capital Efficiency

PNXP didn’t sugarcoat reality. Management openly acknowledged that the cannabis sector no longer offered a viable path forward under current regulatory and capital conditions. Instead of dragging shareholders through years of stagnation, the board made a clean, decisive call: exit cannabis entirely and redeploy the company into a sector with clearer regulatory momentum and vastly larger upside.

That new direction is Real World Asset (RWA) digital lending, operating under the name RWA Loan, Inc.

This isn’t a vague “blockchain pivot.” It’s a clearly defined business model with a planned launch window of February 2026.

What PNXP Is Actually Building

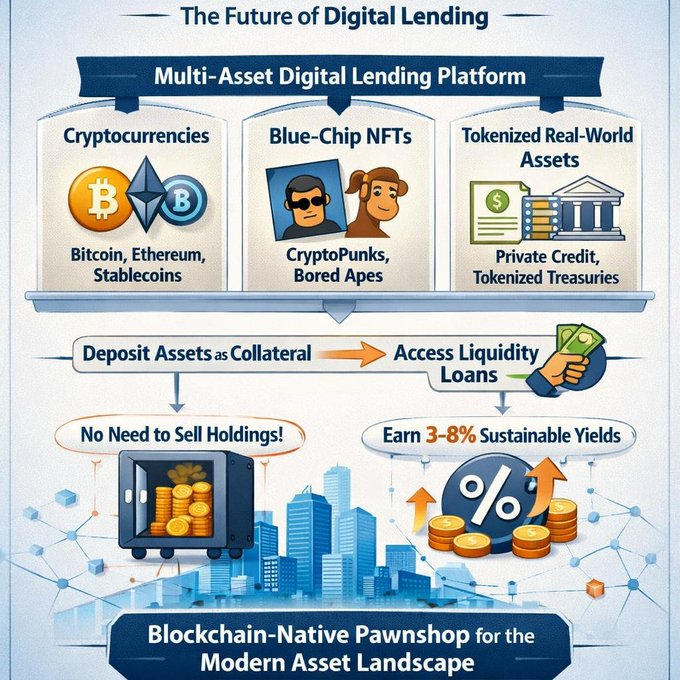

According to its updated OTC Markets business description, PNXP is developing a multi-asset digital lending platform that will accept:

Cryptocurrencies (Bitcoin, Ethereum, stablecoins)

Blue-chip NFTs (CryptoPunks, Bored Apes)

Tokenized real-world assets (private credit, tokenized Treasuries)

Borrowers will be able to deposit assets as collateral and access liquidity without selling their holdings. Lenders, in turn, earn sustainable yields in the 3–8% range.

Think of it as a blockchain-native pawnshop, but built for the modern asset landscape — digital-first, collateralized, and structured for compliance.

This matters because one of the biggest friction points in crypto and tokenized assets has always been liquidity without liquidation. PNXP is attacking that problem directly.

Why This Market Is Bigger Than Most People Realize

The timing here isn’t accidental.

Independent research from firms like BCG, Binance Research, and Ripple points to the tokenized asset market growing into the trillions of dollars over the next decade. Even conservative estimates project $3.5 trillion by 2030, while aggressive forecasts push closer to $18–19 trillion by 2033.

More importantly, RWA lending isn’t just about speculation — it’s about capital efficiency. Academic research suggests full-scale tokenization could unlock up to $2.4 trillion annually in global economic savings.

PNXP isn’t trying to boil the ocean on day one. It’s positioning itself as an early infrastructure provider in a market that institutions are just beginning to take seriously.

That’s where asymmetric upside lives.

Leadership Reset and Clean Narrative

Another encouraging signal was the executive transition announced in December. Key cannabis-focused officers stepped aside as the company formally closed that chapter. While those individuals brought deep expertise to the cannabis phase, their departure clarified the narrative: this is no longer a hybrid story or a half-measure pivot.

Management has committed to:

Completing delayed filings

Weekly shareholder communications

A refreshed corporate identity

A formal operational launch after the new year

That level of transparency is critical during a pivot — and it suggests management understands that credibility has to be earned back through execution, not promises.

Share Structure: Tight Enough to Matter

For a micro-cap pivot play, PNXP’s structure is actually reasonable:

Authorized Shares: 75M

Outstanding: ~45.3M

Unrestricted: ~26.4M

Held at DTC: ~25.5M

This isn’t a bloated, billion-share mess. If momentum builds — especially heading into a platform launch — the structure allows price to respond quickly.

That’s important when you’re talking about a stock this small. It doesn’t take much volume to move the needle.

BFC Takeaway

PNXP may end up being the most misunderstood name on this list — and potentially the most explosive. The market is still pricing it like a failed cannabis company, while management is building toward a completely different future in digital lending and tokenized assets.

There’s real risk here. Pivots always carry risk. But the reward side of the equation is enormous, especially at this valuation.

If RWA lending becomes what many believe it will — a core pillar of next-generation finance — then PNXP’s current market cap doesn’t just look low.

It looks mispriced.

This one feels like the moment when the defense sells out against the old playbook — and suddenly the field opens up.

This content is for education and entertainment only, not financial advice. We’re not your financial advisor — we’re just guys talking stocks by the fire. Micro-cap and OTC stocks are volatile, risky, and can absolutely punch you in the face if you’re not careful.

Do your own due diligence. Read filings. Know the risks. Don’t bet rent money. We may own some of the stocks mentioned and can buy or sell at any time.

.png)

.png)

Comments